Operating Line Loan Service

Farmers can now replace the DocuSign draw request and paper check mailing payment process with a fully digital option for their FBN Operating Line of Credit.

PROJECT HIGHLIGHTS

Payment timeframe decreased from average 7 days to 3 days

79.5% New account linkage time reduced from days to 2 minutes

TIMELINE

Draw Request Digitalization -

ACH Setup via Stripe Integration -

Digital Payment -

TEAM

1 Designer

1 Product manager

1 FE Engineer And 1 BE Engineer

Overview

The operating loan volume has increased by xx% since the launch of the instant approval version. In the 2022 Operating Line season alone, we acquired xx new operating line customers and increased the loan volume by xx. With this influx of customers, some outdated features have become more problematic.

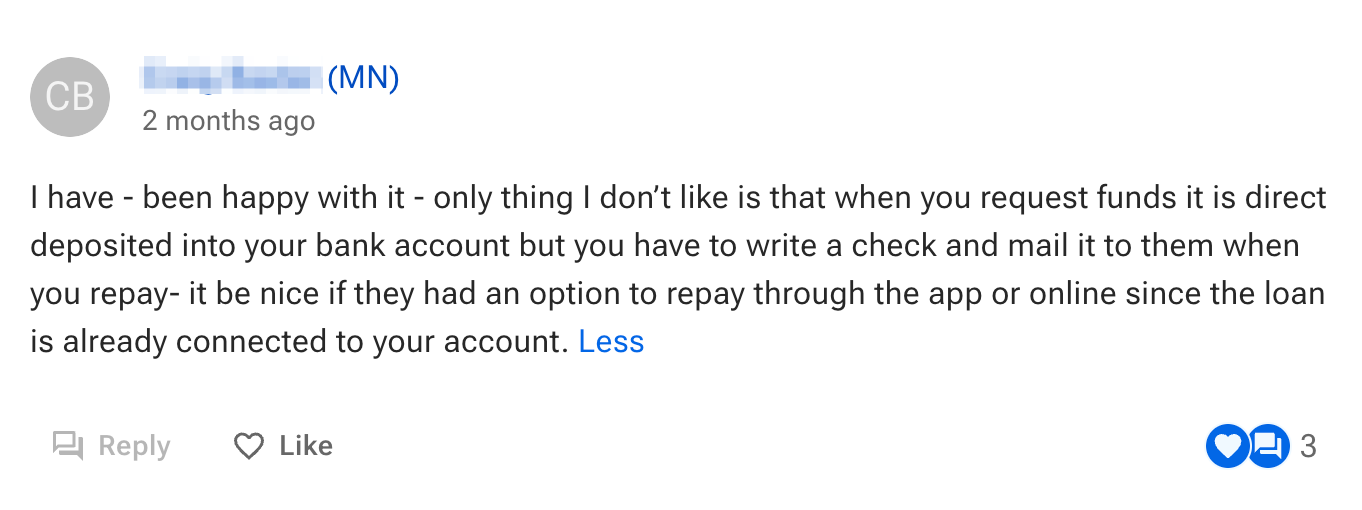

A farmer comment from the Community forum

Along with the issues mentioned above, here are some other pain points that both farmers and the servicing team face:

FARMER PAIN POINTS:

when setting up the ACH - has to fill out a Docusign and email to the servicing team along with a void check and and bank statement when setting up the ACH.

when requesting a draw - has to fill out and email the servicing team a DocuSign every time .

when paying back the loan - to mail paper check every time

SERVICING TEAM PAIN POINTS:

when setting up the ACH for farmer - has to manually verify the bank account information by calling the bank

when review the draw request - has to manually verify each request for abnormal activity

when process payment - has to cash the check in person

Goals

After talking to our current farmer customers and our servicing team member it has become obvious that the features that would help both of them:

1. Access the fund faster, so that farmers can access them in timely matter to keep their operations going whenever they need them during the crop year.

2. Make loan repayment easier and more secure, allowing farmers to spend less time monitoring transactions and more time focusing on their operations, while also instilling trust in every payment transaction.

The team tackled each of the features separately based on resource availability and prioritization for the next year and a half.

Highlight Projects:

Below you’ll find an overview of those projects. I would love to chat about the full process that went into this project with you, so please don’t hesitate to get in touch.

CLICK ON SHORTCUTS:

Digital Loan Payment

Faster and secure way to make operating loan payments.

Real-Time Status Update

Provide more visibility into different loan related transactions.

Digitize Draw Request

A simplified digital request feature to replace DocuSign.

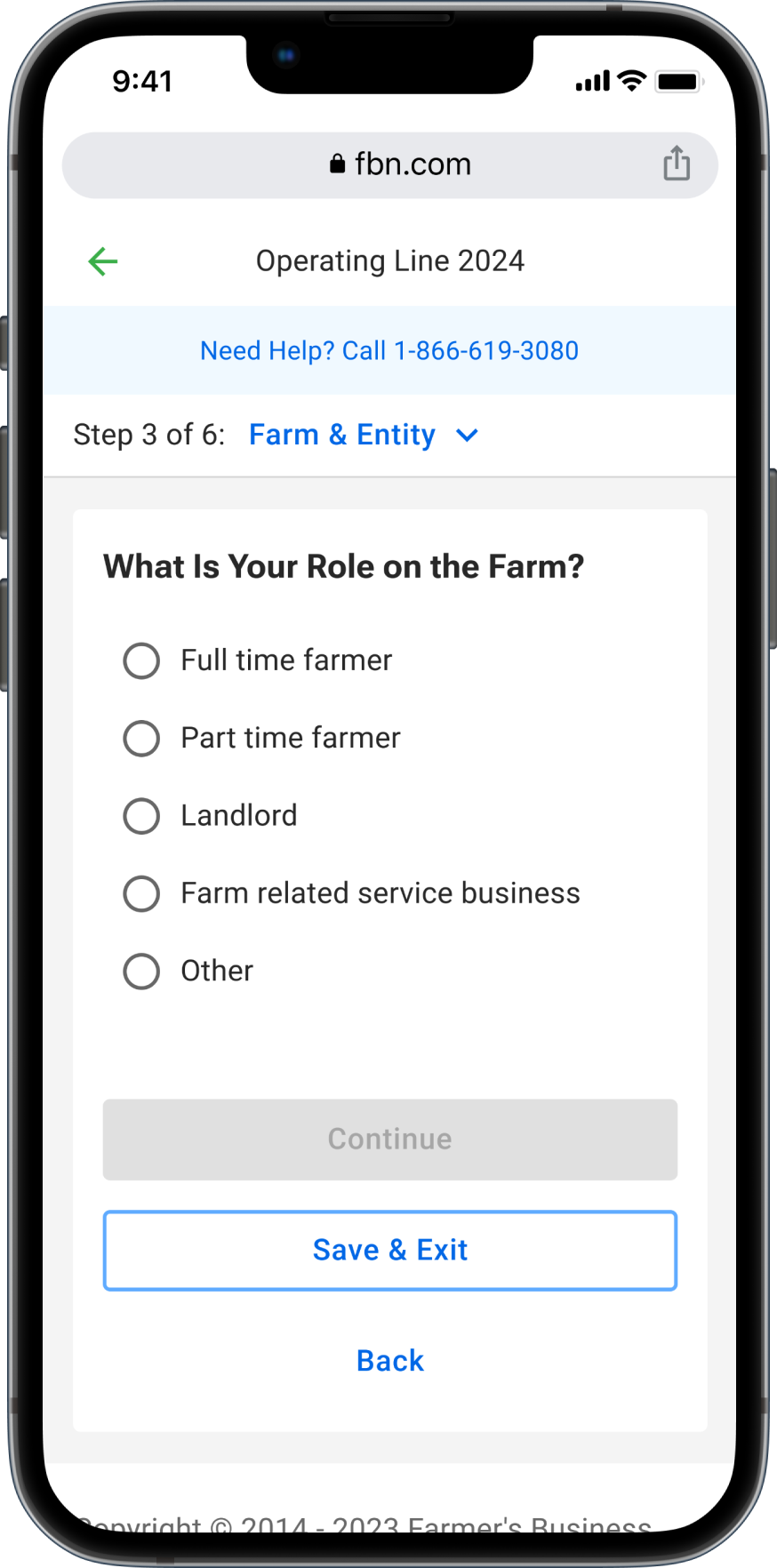

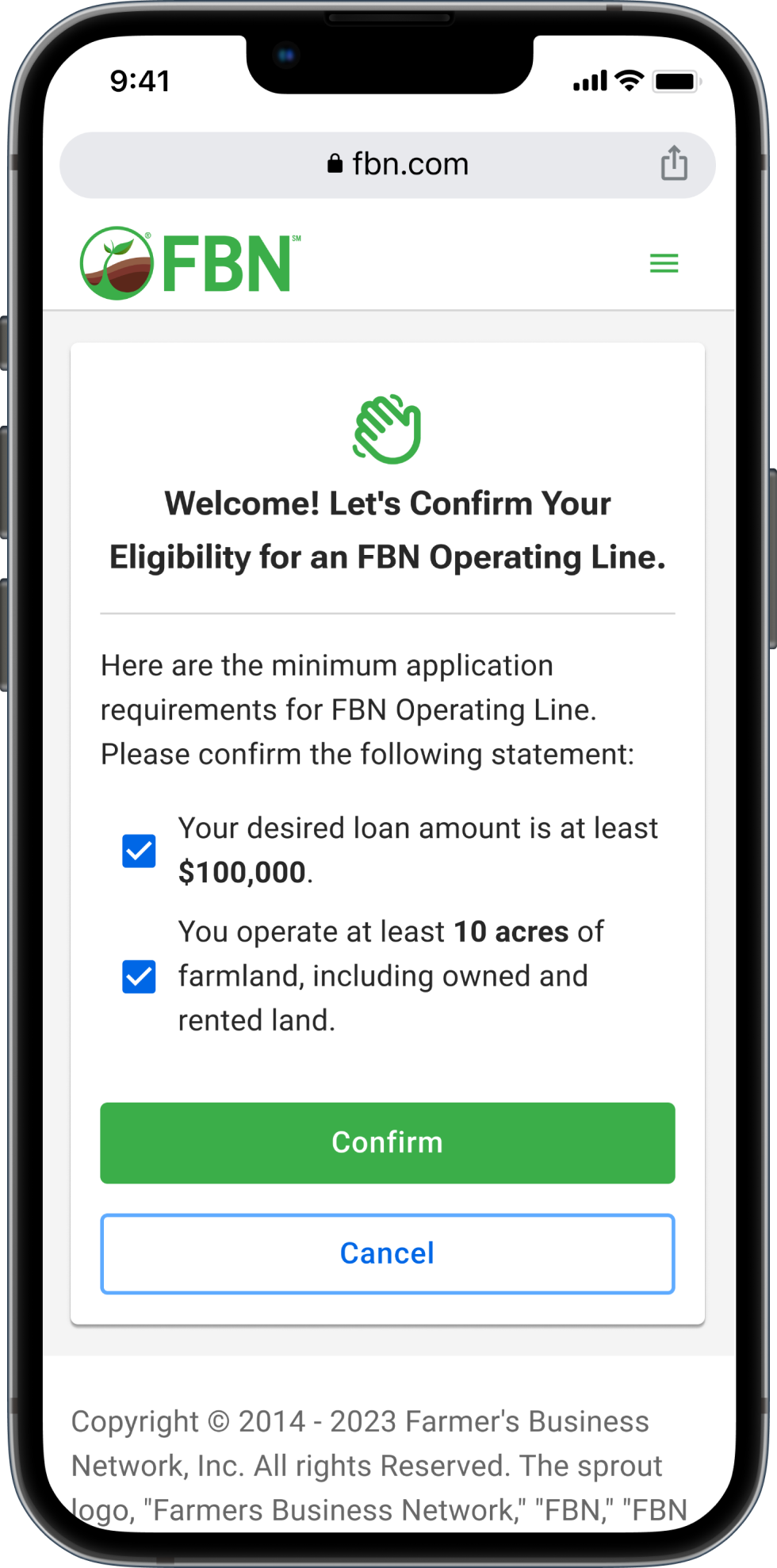

Draw Request: what & why

You might wonder, what is a draw request and why is it necessary?

Operating Line of Credit products in agriculture function uniquely. These loans are tailored for specific needs like buying inputs or equipment. So, even if you're approved for $500k, you won't see it all at once. Whenever you need funds, you submit a request stating its purpose to your lender, they'll review it and, if all checks out, transfer the money to your account.

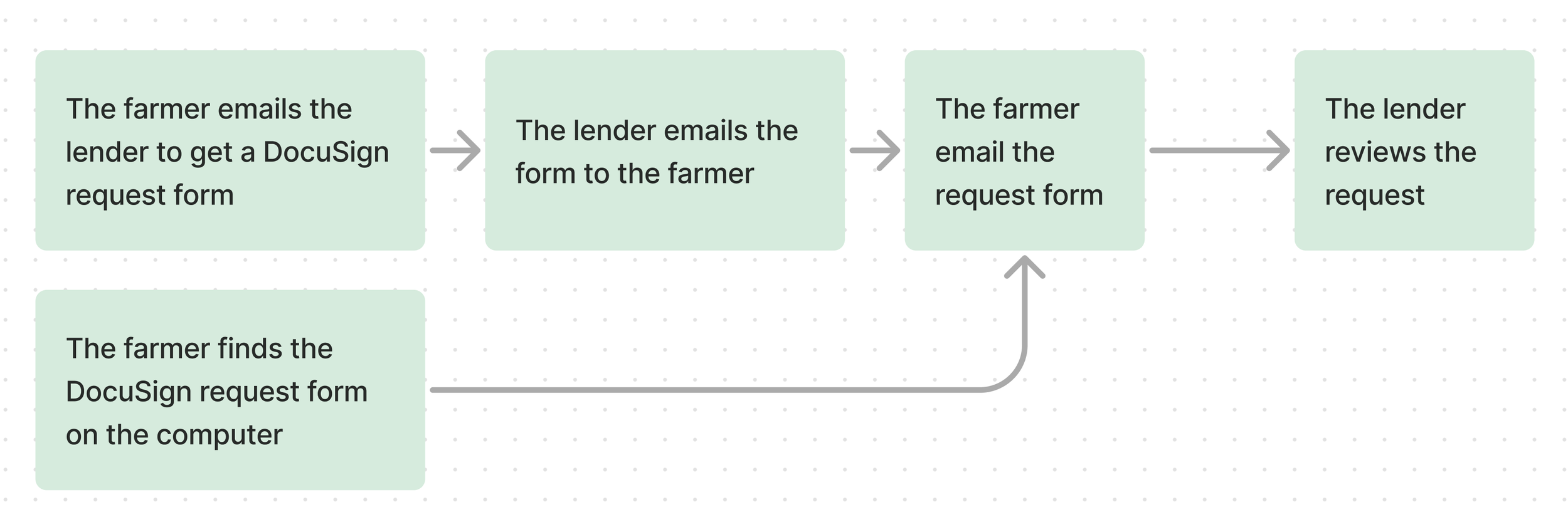

FBN’s Old Request Process

It’s a time consuming.

The problem is that when farmers spend a lot of time in the field or on the way to deliver grains, they often have trouble accessing DocuSign on their phones, filling it out, and emailing it over. They have to wait until the end of the day to get back to the shop to request the draw.

Our first step was to eliminate the need for DocuSign. Since I designed and launched the “My Loans” section earlier that year, it made sense to make FBN the all-in-one place for loan service-related activities. Especially since farmers got the loan via our digital online application, we already had certain loan-related information, so we could simplify some of the required information for draw requests.

This new process helps reduce a huge amount of hassle on the farmers' side and sets the foundation for later features such as transaction tracking and account linkage.

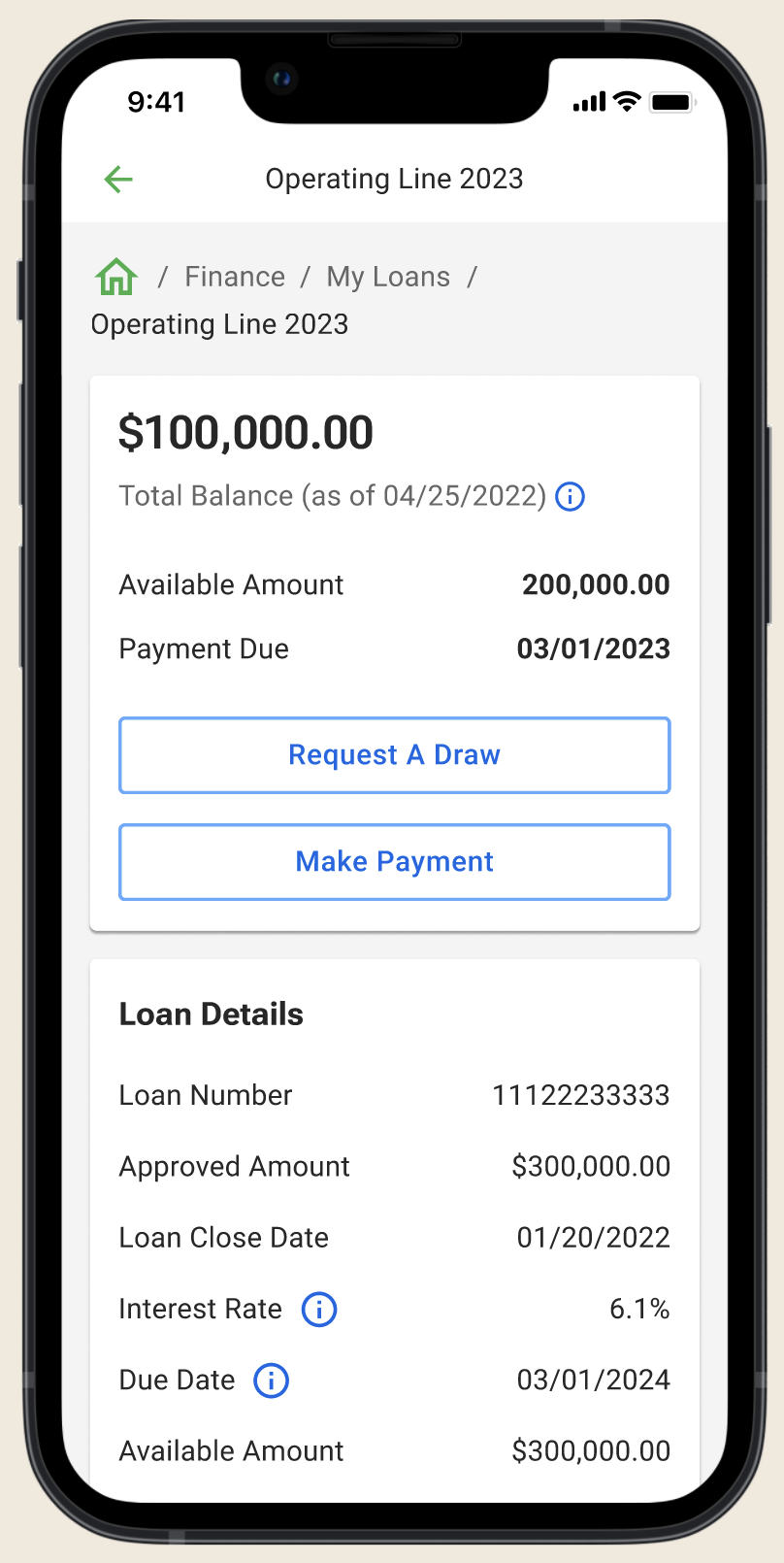

New Draw Request

farmers can now request draws through their app using a simplified digital form, anytime and anywhere.

Initial Draw Request in FBN App

Farmers can now request draws through their app, and they can initiate the draw request with the click of a button.

The Recent Activity Card

We introduced the recent activity card. It offers visibility into transaction details. This feature is scalable for future expansions of online capabilities, such as account linkage, loan payment, and payoff requests. (See real-time status update project here)

Simplified Request Form

Instead of DocuSign, we simplified the request form and loan details are now used to prefill some fields for convenience and data security.

Design Validation

Over the past year and a half, we've repeatedly heard in interviews about how easy it is to request draws. It's consistently mentioned as a benchmark when farmers talk about the features they want in the app:

“ It was straightforward, it was simple, I don't have to contact anyone.”

-D. Halsey

ACH Bank Account Linkage

Reduce the bank account connection from 2 days to 2 minutes.

Overview

Before farmers can start drawing funds, they need to set up the account where they want the funds to go. However, the current process is extremely cumbersome. After the loan is closed, the servicing team sends a separate email with a DocuSign attachment to gather bank account information. To prevent fraud and ensure the money goes to the correct account, farmers are also required to submit a void check and a bank statement along with the DocuSign for FBN to verify. The whole process takes around 2 days.

This process can lead to timing issues, especially if you're at a cattle auction and can't access the funds in time to close the deal or need money to secure a discount with a certain input vendor.

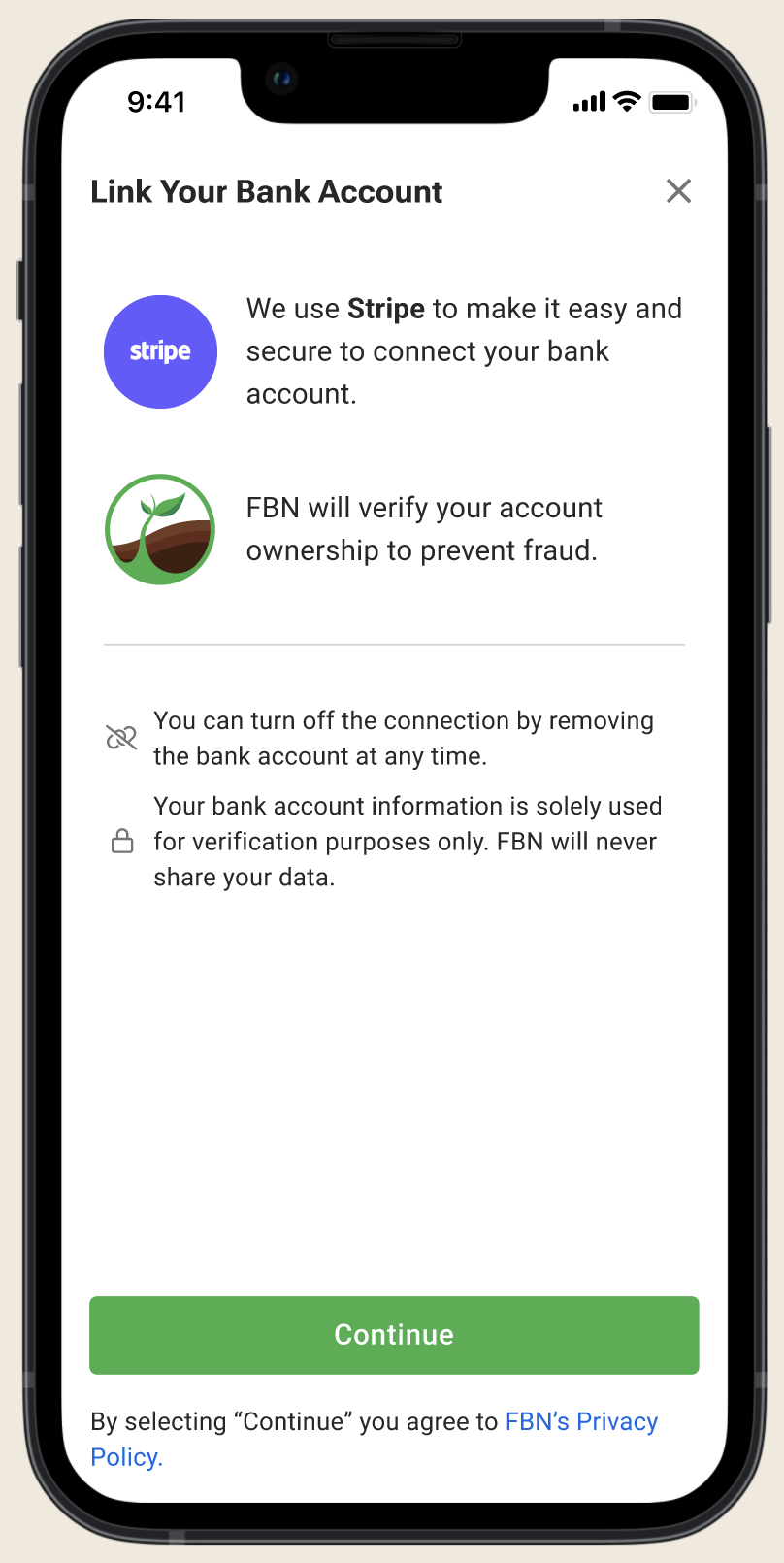

Our recent partnership with Stripe has provided us the capability to validate and link the majority of bank accounts through their linkage service, which could cut down the validation and linkage time to minutes. Since Stripe’s linkage service covers all the user experience during that process, my focus was on the steps before and after the linkage.

Building Trust Through Transparency

When introducing a thrid-party integration just before the farmer provides all their bank account details, being transparent about every single step is crucial when building trust and communicating with farmers. The importance of trust between lenders and desire for transparency were common themes in our CSAT survey. Therefore, I ensured to set up proper expectations before farmers start the linkage process and communicate the status after the linkage process is completed.

The Many States of the Linkage Process

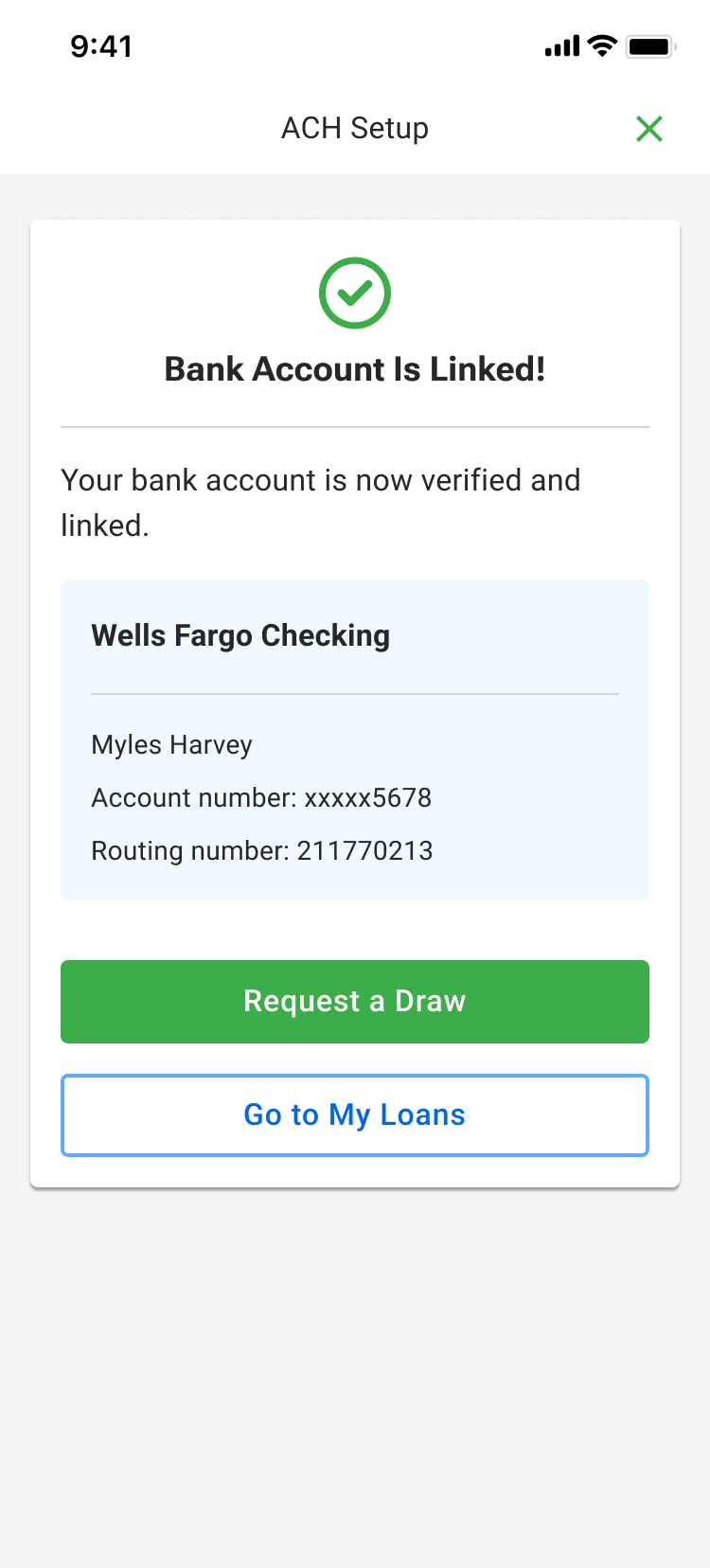

Bank Linked

Using timeline to communicate the current status and next step on the confirmation page.

Double done with the Email notification to ensure to communicate the status.

Setting expectation before the user starts the linkage.

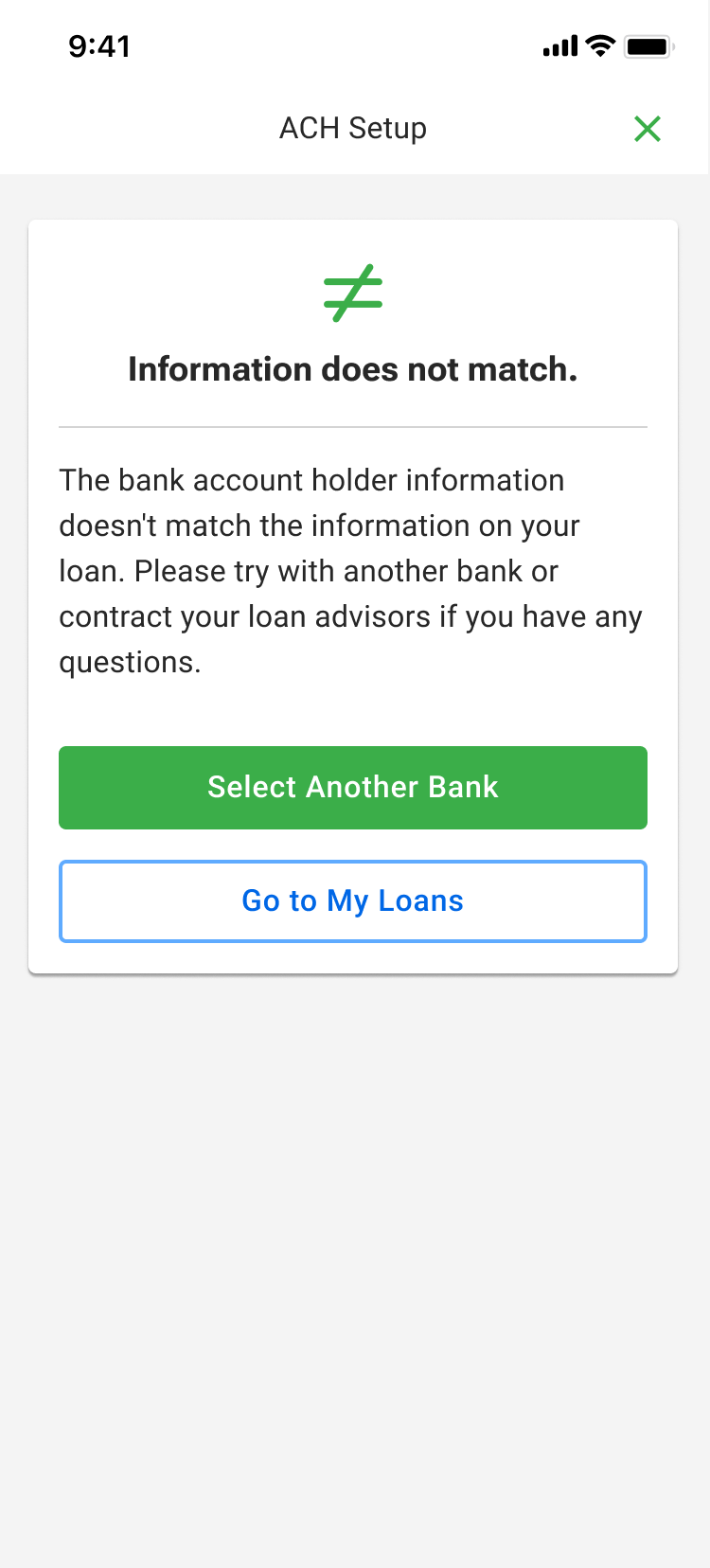

Some of our farmers' primary accounts are with local banks; in fact, 29% of our customers' bank information is not in Stripe's database. Even with the ones in the database, there might be issues such as mismatched information, technical glitches, and unexpected errors. The design needed to reflect the multitude of statistics along with the relevant notifications.

Manual Review

Information Mismatch

Unexpected Error

Digital Loan Payment

Faster and more secure way to make Operating Line payments.

The Infamous Paper Checks

Until now, mailing a check has been the only way to make payments towards the Operating Line. Through various research and interviews with farmers, most of them have mentioned encountering problems with loan payments. The common issues we have heard include:

Problem 1: The mailman lost the check, taking more than a week for the farmer to find out, causing them to pay additional interest.

Problem 2: Farmers wrote inaccurate amounts, leading the need to send extra checks or for FBN to return additional amounts with a check.

Problem 3: Farmers don’t feel safe mailing a check with a large amount, causing them to mail several checks with smaller amounts and pay extra for insurance.

“ I mean the only problem was for some reason the mail carrier dropped it in the mud from the mailbox, which delayed it.”

-M. Dabling

With the previous integration with Stripe, it was time to leverage their payment system to replace the cumbersome paper check repayment process.

Using timeline to communicate current status and next step on the confirmation page.

Double done with the Email notification to ensure to communicate the status.

Setting expectation before the user starts the linkage

Recent Activity Enhancement

Real-time status update to provide more visibility into all transactions。

Overview

Throughout various Operating Line projects, I took the opportunity to implement several design updates to the recent activity card, providing more real-time visibility to farmers. This not only promotes trust but also reduces issues regarding transaction updates. After several optimization, now the recent activity can shows more updated status and additional details (if available), consistently on both farmers and internal platform, so that both parties have the information they need when communication is needed.

Success

Failed

Mini Workflow to Update the Status

While the ideal method for updating the status is fully automated with zero human touchpoints, currently, due to various constraints, automation is not available. But we still want to provide more updated status to customers. To accommodate this, I added a mini workflow in the admin portal, allowing users to quickly update the status.

Pending

Success Metrics

It’s hard to measure success with individual project because the it’s only part of the loan service experience. So instead we looked at the entire experience and measure the success from xx angles:

Loan payment amount processed last week of the deadline compared with last year

Individual Draw Request processor feedback

Speed and volumn of the request process

Tickets regarding the status update.

We talked to the draw request processor team after the last busy season and asked how the new process was, it seems standardized and easy to access data really helped with the teams efficiency. the average process time has decreased from 5 days to 2 days. given there are only 2 people on the process teams

many states of one recent activity.

The recent activity shows the status and additional details (if available) consistantly on both farmers and internal platform, so that they have the information they need when communication is needed.

The designs needed to reflect the multitude of states that an activity can be in pending, success and failed (and additional information that comes with it)

screenshot of pending, success, and fail

Design validation

We measure this from 3 angles. Draw request processor feedback, speed and volumn of the request process and farmer feedback.

We talked to the draw request processor team after the last busy season and asked how the new process was, it seems standardized and easy to access data really helped with the teams efficiency. the average process time has decreased from 5 days to 2 days. given there are only 2 people on the process teams,

over the last a year and half we heard many times in interviews about how easy it is to request draw.

testimonial here.